Seller's Contact Information

- RE: $934K NET Hydraulic Repair Shop

- Contact: Jake Whitta

Business Overview:

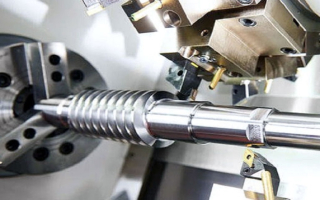

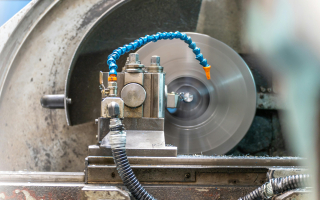

Located in Eastern Michigan, the Company provides high-quality hydraulic repair service to the construction, manufacturing, and industrial service industries. They have served the area for over 40 years, is well know in the industry as the go-to shop in the region. The operation is staffed with well-tenured and skilled workforce than machines, welds, fabricates, hones, polishes, assembles, and finishes hydraulic cylinder repairs for their customers.

Financial overview:

Revenue By Year:

2023 - $2,324,859

2022 - $2,079,375

2021 - $1,878,022

3-Year Average: $2,094,085

SDE By Year:

2023 - $934,343 (40.2%)

2022 - $828,445 (39.8%)

2021 - $701,263 (37.3%)

Real Estate: The real estate is owned by the Seller and is to be sold with the business for $1,000,000 (not included in the asking price). The building is in excellent condition and includes over 10,000 Square Feet of shop space and over 1,500 Square Feet of office space. The shop area has plenty of ceiling clearance height with overhead cranes and ample height under the hook for handling repair and overhead doors for easy loading and unloading of equipment that needs to be repaired.

Property Features and Assets:

Real Estate Asking Price: $1,000,000.00

Square Units (Foot, Meter): 11,550

Facilities: The building is in excellent condition and includes over 10,000 SF of shop space and over 1,500 SF of office space. The shop area has plenty of ceiling clearance height with overhead cranes and ample height under hook for handling repair and overhead doors for easy loading and unloading of equipment that needs repaired.

Reason for Selling:

Retirement. Kindly ask the seller for more information.

Additional Details:

- The property is owned.

- The owner is willing to train/assist the new owner.

- This is not homebased business opportunity.

- This is not a franchise resale opportunity

Relevant Links:

Opportunity Update!

Exciting update: $934K NET Hydraulic Repair Shop has a new owner due to high interest! More opportunities await. Explore our site for other listings or sign up here for email alerts. Find your perfect business opportunity today!

Asking Price: $4,575,000

Asking Price: $4,575,000Very Profitable Long-Standing Metal Manufacturer

Great opportunity to own a well-established metal manufacturing business, which has stably grown over the past 20 years with one owner. Niche industry with few competitors and high barriers to entry.

Asking Price: $95,000

Asking Price: $95,000Established Wholesale Industrial Supplies Company

Established profitable industrial supply (fasteners, hardware, tools) company. Owner operator, has loyal customers who order by email or phone. Price includes inventory of $50,000.