401K Business Funding

Quick Summary

This is not a franchise. It is a way to fund your new business. Did you know you are allowed to convert your 401K or IRA account into cash to buy a small business without incurring any taxes or penalties? Over the past 20 years, we have helped hundreds of clients do just that using our 401K Business Funding Plan. And our fee has always been 40% lower than what other firms charge. (You will need more than $50,000 in your 401K to qualify.) Learn more now!

*Please contact "401K Business Funding" to confirm the accuracy of any information provided on this page.

401K Business Funding

Business Cost, Fees & Facts for 2026

| Minimum Cash Required | $20,000 |

Available In These States:

- Overview

- Testimonials

401K Business Funding

HOW TO USE YOUR 401K TO BUY A FRANCHISE

Did you know you are allowed to convert your 401K into cash to buy a small business without incurring any taxes or penalties.

Over the past 20 years, we have helped hundreds of clients do just this with our 401K Business Funding Plans.

HOW DOES THIS WORK?

With the adoption of a 401K business funding plan, you are allowed to convert your 401K into privately-held stock in your new business with no taxes or penalties due.

For this tax-deferred transfer, we create a 501A trust and couple it to special “exemption clauses”.

In this way, you would not be “cashing out” your 401K. When you invest these savings into a business, the IRS accepts this as a tax-deferred “rollover,” which allows you to keep the 35% to 40% you would have paid in early-distribution taxes and invest that extra money in the business. It’s pretty much a no brainer.

We have helped hundreds of clients over the past two decades get tax-free access to their 401K, 403B, 457, and IRA funds to buy or startup their own businesses.

This is a great alternative to borrowing money from a bank since you won’t have to pay back any principal or interest payments.

WHY PICK US?

- For starters our fee is 40% lower than other firms.

- Unlike others that require their fee upfront, we don’t charge a dime until after our clients receive all of their money.

- The other firms charge $1,600 or more a year in plan maintenance fees. We don’t charge a dime.

- We have a reputation of helping clients years later at no cost.

MORE CASH TO BUY YOUR FRANCHISE

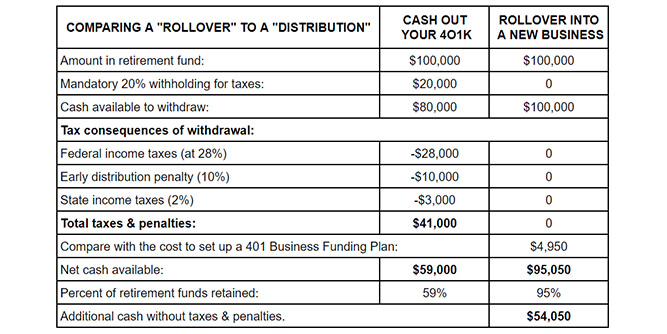

With the example below, for every $100,000 you rollover from your 401K, you get to keep $41,000 you would have paid in taxes and invest it in your new business.

HERE ARE THE NUMBERS

| COMPARING A "ROLLOVER" TO A "DISTRIBUTION" | CASH OUT YOUR 401K | ROLLOVER INTO A NEW BUSINESS |

|---|---|---|

| Amount in retirement fund: | $ 100,000 | $ 100,000 |

| Mandatory 20% withholding for taxes: | $ 20,000 | $ 0 |

| Cash available to withdraw: | $ 80,000 | $ 100,000 |

| Tax consequences of withdrawal: | ||

| Federal income taxes (at 28%) | $ -28,000 | $ 0 |

| Early distribution penalty (10%) | $ -10,000 | $ 0 |

| State income taxes (2%) | $ 0 | $ 3,000 |

| Total taxes & penalties: | $ 38,000 | $ 3,000 |

| Compare with the cost to set up a 401K Business Funding Plan: | $ 4,950 | |

| Net cash available: | $ 59,000 | $ 95,050 |

| Percent of retirement funds retained: | 59% | 95% |

| Additional cash without taxes & penalties. | $ 54,050 |

HOW TO USE YOUR 401K TO BUY OR START UP YOUR OWN BUSINESS - AND GET A DOWN PAYMENT FOR AN SBA LOAN, IF NEEDED:

How to get an SBA Loan Down Payment

• Last year, the SBA backed 52,000 loans for small businesses.

• The 7A loan can be used to finance any business purpose, including a startup, an acquisition, working capital, salaries, equipment purchases, inventory, and real estate.

• All SBA loans require you to make a down payment ranging from 10% to 30% of the principal. The inability to make a large enough down payment can disqualify you from being approved.

• There are other forms of funding to cover the loan down payment, including tax-free 401K and IRA rollovers.

• If you have socked away savings in a 401K or IRA account, there is a way to use these dormant funds for your SBA Loan down payment.

• For years, SBA lenders required every investor in a new business to have a 20% interest or more to cosign the note. A 401K could not be part of the investment because it could not “encumber itself”.

Request more information now!

Dean, I received my funds today, and I am very excited to begin this new journey. I cannot tell you how much I appreciate the service and professionalism you demonstrated throughout.”Tim Jones

I have been thinking, dreaming, and preparing to have and run my own business since I was a teenager, but today was the first real step towards making it happen. I still don't fully understand all of the steps yet but talking with you and hearing your confidence assured me that everything is going to be fine and you are the right person to get me through this process. Many thanks.Mike Butler

Hello Dean, the exact amount is $205,109.04. Fidelity acknowledged they have all the documents they need to proceed with my tax-free rollover. Again, I want you to know how much I appreciate how you haveRobert Walker

I was a bit skeptical, but after confirming that the money is arriving in my bank account this morning, I am SO PLEASED with your work and due diligence!Enrique Valdez

All is going well for us, and access to our retirement funds has made everything so much easier. Thank you for providing this service! Most people I talk to about the pension trust arrangement are amazed that it is possible and, better yet, pain-free with the support you provide.Linda Moore

You guys are awesome, you are on it!Yes sir, my rollover check just cleared this morning and is available to invest in my new business. I was chatting with my mom and she may be interested in doing the same thing with her 401K.”Charlie Heum

Here are some other suggestions in the same category that you selected :

Blue Coast Savings Consultants

Blue Coast Savings Consultants is a leading consultancy in cost savings and expense reduction. For over 30 years, our advisors have helped businesses enhance their profits and achieve greater financial flexibility by cutting unnecessary costs. If we don’t deliver savings, there’s simply no fee.

$ 70,000 Min.Cash Required

Global Financial Training Program

Want to earn big commissions in the lucrative financial industry but you lack the experience? Let Global Financial Training Program help you get started! With comprehensive training, marketing support and the potential to earn a high annual income, you can hit the ground running! Contact us today to learn more.

$ 19,950 Min.Cash Required

American Business Systems, LLC

American Business Systems has been America's Leader in Medical Billing with Unparalleled Training, and Support for over 25 years. $100k Potential working from anywhere, full-time or part-time. Learn more about this great opportunity!

$ 35,000 Min.Cash Required

ClaimTek Systems

Start a Medical & Dental Billing and Practice Management Business – Work from anywhere, part-time or full-time, flexible schedule, huge profit margins! Healthcare is the growth industry of the 21st century! Read more about this exciting opportunity now!

$ 20,000 Min.Cash Required

PostalAnnex+

Own and operate your own shipping company with Postal Annex+! Our marketing strategies, site selection, management assistance and other support programs take out the guesswork, allowing you to make more money. Contact us today to get started!

$ 40,000 Min.Cash Required

Valcor Small Business Advocates

Small business owners are the backbone of our economy, representing 99.9% of US businesses. Our goal is simple: Save small businesses and the employees’ jobs that rely on those troubled companies. Valcor's 3 prong approach includes Debt Mediation, Business Restructuring, and Capital Acquisition. Run your executive-level business from home while helping save small businesses.

$ 30,000 Min.Cash Required

Paramount Tax

Paramount Tax franchise is here to help individuals, CPAs, and small tax firms find the organization and access support and resources necessary to compete with big name tax preparers. Franchising with Paramount Tax gives you the training, job security and flexibility you need to find success--no matter your level of experience. Learn more now!

$ 50,000 Min.Cash Required

Purchase A Franchise Using Your Retirement Plan

This is NOT a franchise or business opportunity. This is a service offered to those seeking to purchase a franchise or business using their retirement funds without having to pay the taxes and penalties. You can purchase a franchise or traditional business with a tax qualified retirement plan such as an IRA, 401(k), 403(b), 457(b), SEPs and others.

$ 30,000 Min.Cash Required

Voda Cleaning & Restoration

Voda Cleaning & Restoration delivers two franchises in one. Owners operate both cleaning and restoration services across residential and commercial customers, creating multiple revenue streams from a single brand. Powered by centralized marketing, repeat-customer demand, and scalable systems, Voda helps franchisees drive jobs, loyalty, and long-term value—without working harder or spending more.

$ 75,000 Min.Cash Required

Blue Edge Financial

Most franchises ask for $100,000+ and years of your life before you see a dime. Blue Edge Financial works differently. We've spent 6 years developing an AI-powered algorithmic system that lets you profit from the markets - without risking your own capital. No storefront nor staff needed. Just smart technology and real coaching. Over 1,400+ people have used this to build income on their own terms. We're not the right fit for everyone. But if you're looking for something smarter, we should talk.

$ 30,000 Min.Cash Required

FocalPoint

Our franchise allows you to combine your extensive skills and experience with our Brian Tracy proven content to produce massive business improvement and individual success. Our coaches are passionate and energized by the thrill we get when we help others be their very best. Our incoming coaches are walked step by step through a detailed and thorough onboarding process. Following certification training, incoming coaches participate in two simultaneous programs, both which focus on the necessary aspects required to help you get your coaching practice producing revenues quickly. Because of our proven content, core values, and extensive experience of our coaches, we are the coaching franchise of choice.

$ 75,000 Min.Cash Required

NTV360

NTV 360 presents a turnkey digital advertising franchise opportunity that delivers a high-margin, recurring revenue model. NTV 360's model allows entrepreneurs to place indoor digital billboards in high-traffic venues, such as restaurants, gyms, and medical offices, at no cost to the business owner. Franchisees generate revenue by selling ad placements to local businesses, tapping into a proven advertising model that requires no employees, inventory, or storefront.

$ 30,000 Min.Cash Required

BooXkeeping

BooXkeeping is a remote, outsourced bookkeeping franchise that helps small-to-medium-sized businesses simplify and standardize their financial operations. Operating within an approximately $80 billion industry, BooXkeeping is positioned at the intersection of recurring revenue, business services, and franchising.

$ 50,000 Min.Cash Required

Minuteman Press - We Design, Print & Promote...YOU!

Serving the business community for over 50 years, Minuteman Press’ customer service driven business model provides digital print, design and promotional services to businesses. Today we are much more than just print, we can provide anything you can put a name, image or logo on!

$ 50,000 Min.Cash Required

Driving Academy

Discover a high-demand, affordable franchise that helps students get on the "Road to Freedom". As a Driving Academy truck driving school you’ll access our proven, scalable systems designed to accelerate your profit, comprehensive training and REAL ongoing support after you open. No trucking experience needed.

$ 150,000 Min.Cash Required

KeyRenter Property Management

Rental properties are on the rise and there has never been a better time for our booming industry. Keyrenter is not dependent on the economy. In fact, the current market has created a meteoric business trend resulting in a prime opportunity for residential property management. Recurring Monthly Income. You will be required to obtain a real estate license as part of your initial training.

$ 50,000 Min.Cash Required

SiteSwan Website Builder

Start your own web design business with SiteSwan. Create & sell websites to small businesses in your area with our easy-to-use, private label website builder. Set your own prices - keep 100% of the sales. Our turnkey platform is designed for anyone looking to sell websites to small businesses - no experience needed.

$ 199 Min.Cash Required

Growth Coach - Business Coaching

The Growth Coach is a leading business coaching franchise that gives you more than just income—it gives you freedom. Our proven systems empower you to build a flexible, fulfilling business with no employees, no inventory, no expensive location—and no burnout. You’ll have the chance to make the money you want while designing a schedule and lifestyle that works for you.

$ 50,000 Min.Cash Required

PuroClean

Own a scalable, high-margin property restoration franchise in a recession resistant industry.

$ 75,000 Min.Cash Required

Skedaddle Humane Wildlife Control

Own a high-demand, recession-resistant business in the booming wildlife removal industry—with a low investment, strong returns, minimal competition, and multiple revenue streams. This is a manager-run model, meaning you won’t handle wildlife yourself; instead, you’ll oversee a growing team and a thriving, profitable operation.

$ 75,000 Min.Cash Required

DOXA

For experienced professionals with an established business network of business contacts. DOXA offers a mission-driven recurring revenue opportunity to build a scalable staff outsourcing business. By connecting US companies with highly skilled global talent.

$ 125,000 Min.Cash Required

Rytech Water Damage & Mold Specialists

If you are searching for a rewarding and profitable business to own, look no further than Rytech. We are an established service provider franchise in a virtually recession-proof industry. Water and fire restoration along with mold remediation services are part of a multibillion-dollar industry that offers potential franchisees the opportunity to build a successful business. Learn more about becoming part of this ever-growing industry today and reach out to our franchising team.

$ 75,000 Min.Cash Required

Lawn Doctor

Lawn Doctor offers custom lawn care solutions to residential and business consumers, including lawn services, pest control, and tree and shrub care. With over 45 years of experience in the industry, Lawn Doctor stands apart by being the leader in customer satisfaction, with an average customer retention rate of over 80%. Lawn and landscape services are a $67 billion-a-year industry, and each year more homeowners switch away from do-it-yourself lawn care to effective professional solutions.

$ 60,000 Min.Cash Required

One Hour Heating & Air Conditioning

At One Hour Heating & Air Conditioning, we’ve helped newcomers to the HVAC industry start successful businesses. With our approach to opening new locations, you don’t have to worry about the level of experience you have in the HVAC industry. Learn more about the costs, benefits, and available locations today!

$ 75,000 Min.Cash Required

Steamatic - Restoration - Construction - Cleaning

Steamatic has the knowledge, tools, and investment in resources to educate and guide anyone who has the drive and entrepreneurial spirit to run their own business.

$ 50,000 Min.Cash Required

Goosehead Insurance

The personal lines insurance market is a robust $534 billion industry. By partnering with Goosehead, you can secure your financial future with our diverse range of products designed to maximize recurring revenue. Discover how to take advantage of this growth opportunity today.

$ 50,000 Min.Cash Required

Express Employment Professionals

Express Employment Professionals is the top staffing franchise in North America. Ranked #1 by Entrepreneur Magazine for 13 consecutive years, we have more than 860 awarded locations with an average of more than $6.4 million in top-line sales for mature offices. The staffing industry is recession-resilient and stays strong despite market changes. Start-up costs are low and there's no inventory. The average office places 650 job seekers a year and supports outreach programs in your community to make a huge impact. Express believes in helping you succeed with 8-5 office hours that provide optimal work-life balance.

$ 150,000 Min.Cash Required

ENVIRO-MASTERS

Enviro-Master is a commercial cleaning franchise specializing in deep-cleaning, sanitization, and health-focused services that go far beyond standard janitorial work. With low overhead, no storefront required, and recurring revenue through service contracts, this scalable opportunity is ideal for growth-minded entrepreneurs. Franchisees receive robust support including business coaching, marketing, lead generation, and national account access.

$ 100,000 Min.Cash Required

Compare & Contrast Brands - Guided Discovery Included

No-cost, guided franchise discovery for professionals who want to compare and contrast multiple brands before committing. I help you avoid wasted time and wrong-fit opportunities by focusing only on franchise models that align with your income goals, lifestyle priorities, and long-term vision, so you can choose with clarity and confidence.

$ 100,000 Min.Cash Required

FranServe - Become a Franchise Consultant!

As a FranServe franchisee, earn money helping people buy a franchise. Work full or part time from a home office. Comprehensive training and support provided. Learn more about the costs, benefits, and available locations today!

$ 50,000 Min.Cash Required