Seller's Contact Information

- RE: 45 Year Old Davenport Machine Shop

- Contact: Ed Anderson

Business Overview:

45 Year old Davenport automatic screw machine shop in Orange County, building included. The revenue and SDE figures presented are for the fiscal year ending 7/31/2024. This business has operated continuously for 45 years. It initially operated as a rebuilder of Davenport screw machines, then as a Davenport machine shop starting in the mid-eighties. Through this long operating history The Company has earned a strong reputation as a high-quality machine shop via high quality, quick order turnaround and outstanding customer service. The book of business has a reasonable degree of customer industry diversification, and the customer base has included highly recognizable companies and brands. The business/building is located in a well-maintained industrial area comprised of stand-alone buildings and a variety of industrial manufacturing enterprises. The building is further described in text below. The employees have long tenures with the Company and are experienced and capable in all aspects of Davenport operation, setup and maintenance. The operation is not overly dependent upon the owners for day to day production and operations. The production processes and quality assurance tasks are well documented. The owners primarily handle preparation of quotes, material ordering and accounting. The Company has strong relationships with key vendors. The machinery and equipment that will be transferred includes the following: • Qty 16 Davenport Screw Machines (16 in operation) • New Britian Screw Machine 1 5/8 cap. Air Threading • Caterpillar Forklift (4000 lb cap) • Donaldson Torit Air Cleaning System • Air King Air Filtering System • K O Lee Tool & Cutter Grinder w/ Collets and fixtures • Black Diamond Drill Grinder • Darex Drill Grinder • H628 Lathe • Diamond Milling Machine • Avon Fallen Stamping Machine • Bear Centrifuge (15 gal) • CAS 55 g Drum Scale • Hydraulic Press • Drill Presses • Belt Sander • Chop Saw The successful buyer will be knowledgeable in machine shop operations, preferably familiar with Davenport automatic screw machines. The building is not currently fully utilized by the financial performance of the business. To effectively leverage the building, the ideal situation would be the relocation of a buyer operation into the building to fill capacity. There is sufficient space to allow for reorganizing equipment if it is desirable to commission CNC machines in the facility as a compliment to the Davenport machines. The preference is to sell the business and building together. Offers for the business only will be accepted, however offers for the building only will not be accepted until after the business is sold. If the business is purchased separate from the building, the business will have to be relocated to a buyer controlled facility. The Sellers will not entertain entering into a lease agreement of any duration to allow for business operations to continue operating in place in the building.

Market Competition and Expansion:

In Southern California there is a vibrant, dynamic demand for machine shop services and products due the the breadth and complexity of manufacturing (customers) in the region. Successful companies offer exceptional quality via the abilities to hold tight tolerances, quick turnaround and a price commensurate with the quality and services offered.

Reason for Selling:

Retirement. Kindly ask the seller for more information.

Additional Details:

- The property is owned.

- This is not homebased business opportunity.

- This is not a franchise resale opportunity

Relevant Links:

Opportunity Update!

Exciting update: 45 Year Old Davenport Machine Shop has a new owner due to high interest! More opportunities await. Explore our site for other listings or sign up here for email alerts. Find your perfect business opportunity today!

Asking Price: $98,000

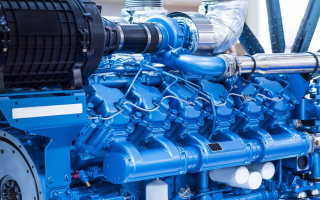

Asking Price: $98,000High Performance Auto Machine Shop

Long-standing reputation in high-performance machining !Exclusive in-house manufactured Jeep I6 specialty parts - a niche revenue stream.Equipment at value $150K -older but well-maintained and fully operational.Three skilled engine machinists, that want to stay on for new owner.