Seller's Contact Information

- RE: Metal Parts Manufacturer/Aerospace

- Contact: Jona Quiles

Business Overview:

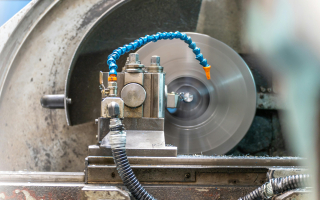

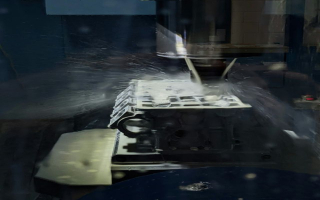

Specialize mostly in CNC machining, doing most of the work for the aerospace industry.

We are AS-9003 certified and also approved for sub tier control (for Lockheed martin), we are also approved for DFARS 252.204-7012.

Reason for Selling:

Retirement. Kindly ask the seller for more information.

Additional Details:

- The property is owned.

- The owner is willing to train/assist the new owner.

- This is not homebased business opportunity.

- This is not a franchise resale opportunity

Relevant Links:

Opportunity Update!

Exciting update: Metal Parts Manufacturer/Aerospace has a new owner due to high interest! More opportunities await. Explore our site for other listings or sign up here for email alerts. Find your perfect business opportunity today!

Asking Price: $4,575,000

Asking Price: $4,575,000Very Profitable Long-Standing Metal Manufacturer

Great opportunity to own a well-established metal manufacturing business, which has stably grown over the past 20 years with one owner. Niche industry with few competitors and high barriers to entry.

Asking Price: $95,000

Asking Price: $95,000Established Wholesale Industrial Supplies Company

Established profitable industrial supply (fasteners, hardware, tools) company. Owner operator, has loyal customers who order by email or phone. Price includes inventory of $50,000.